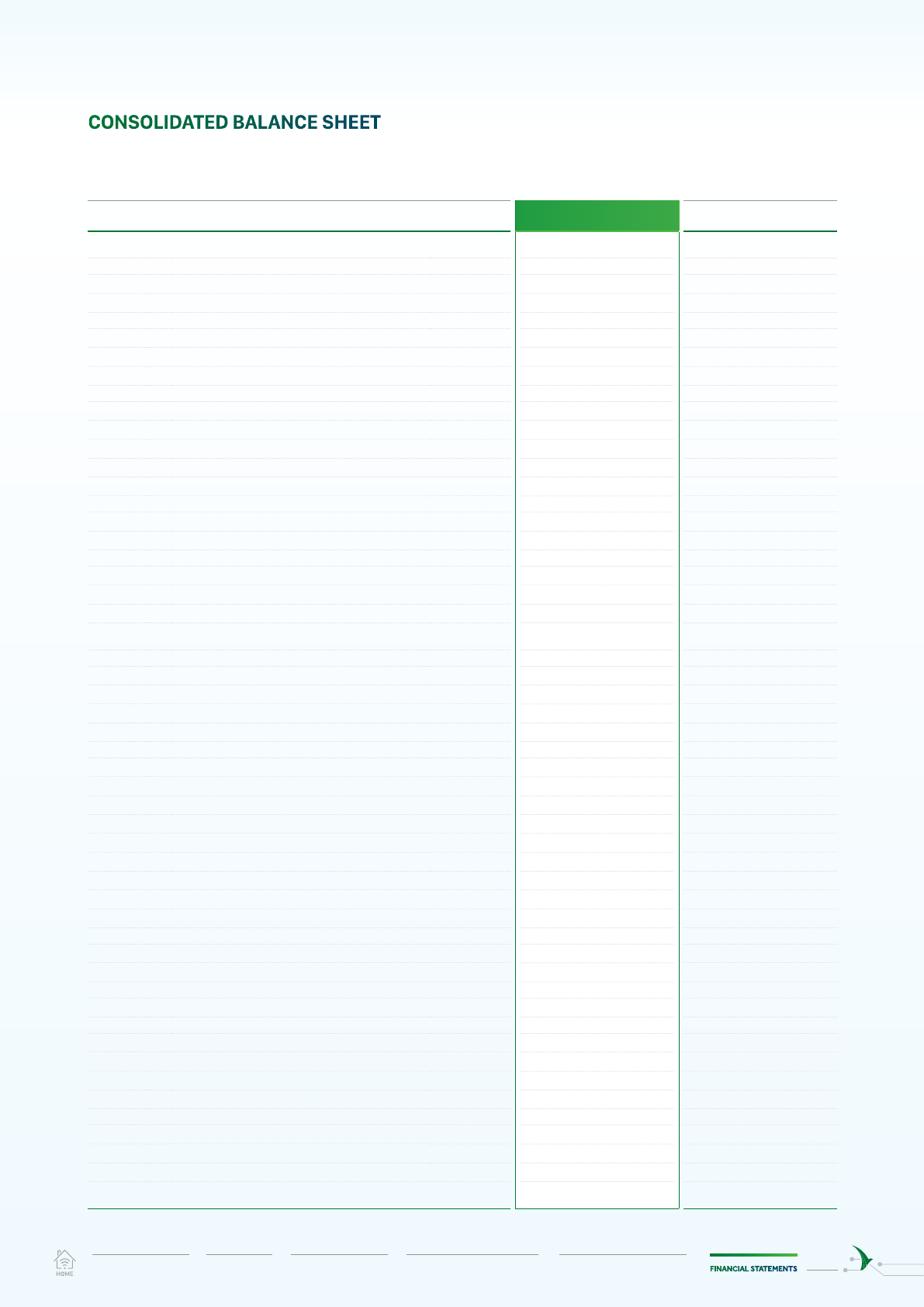

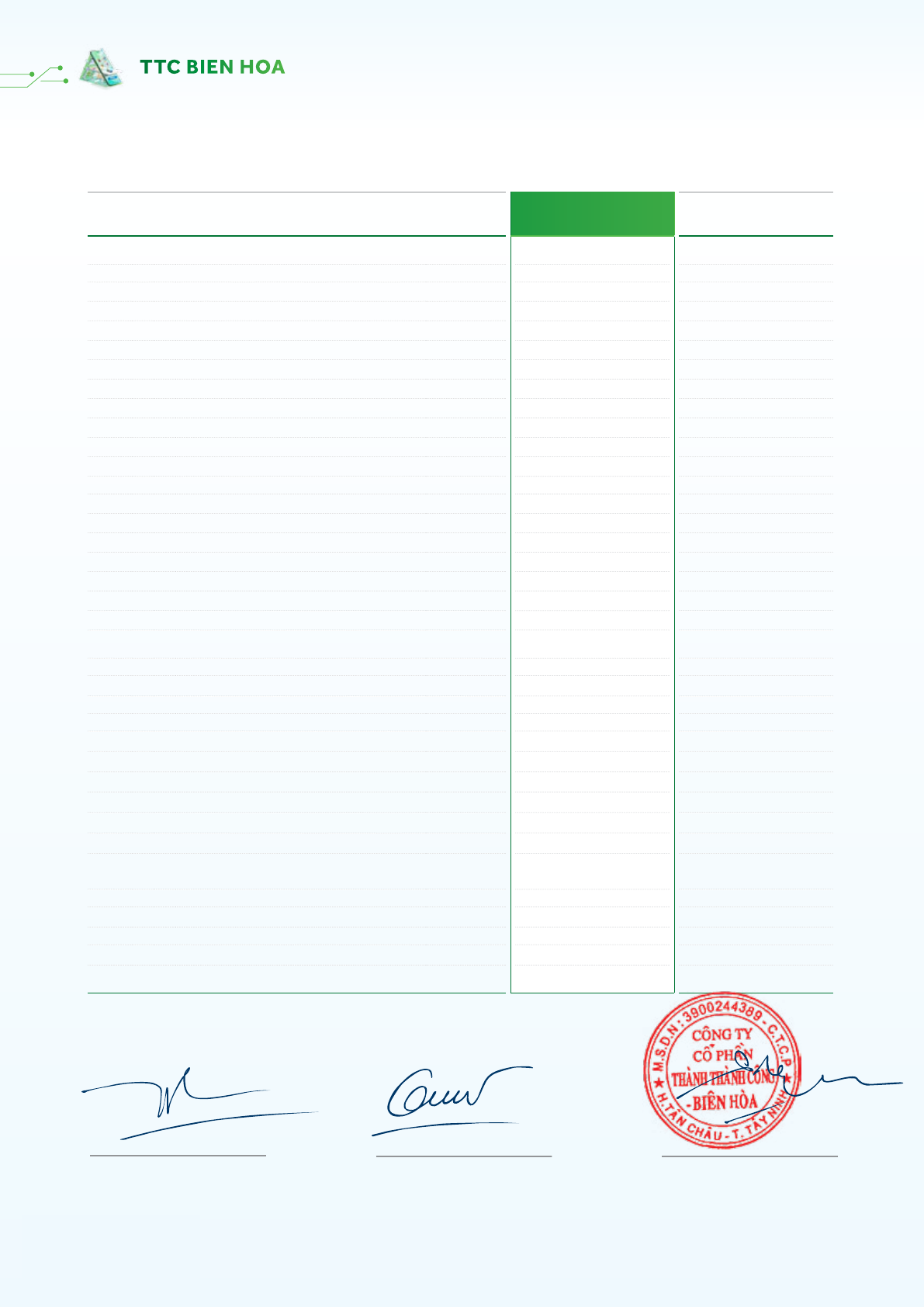

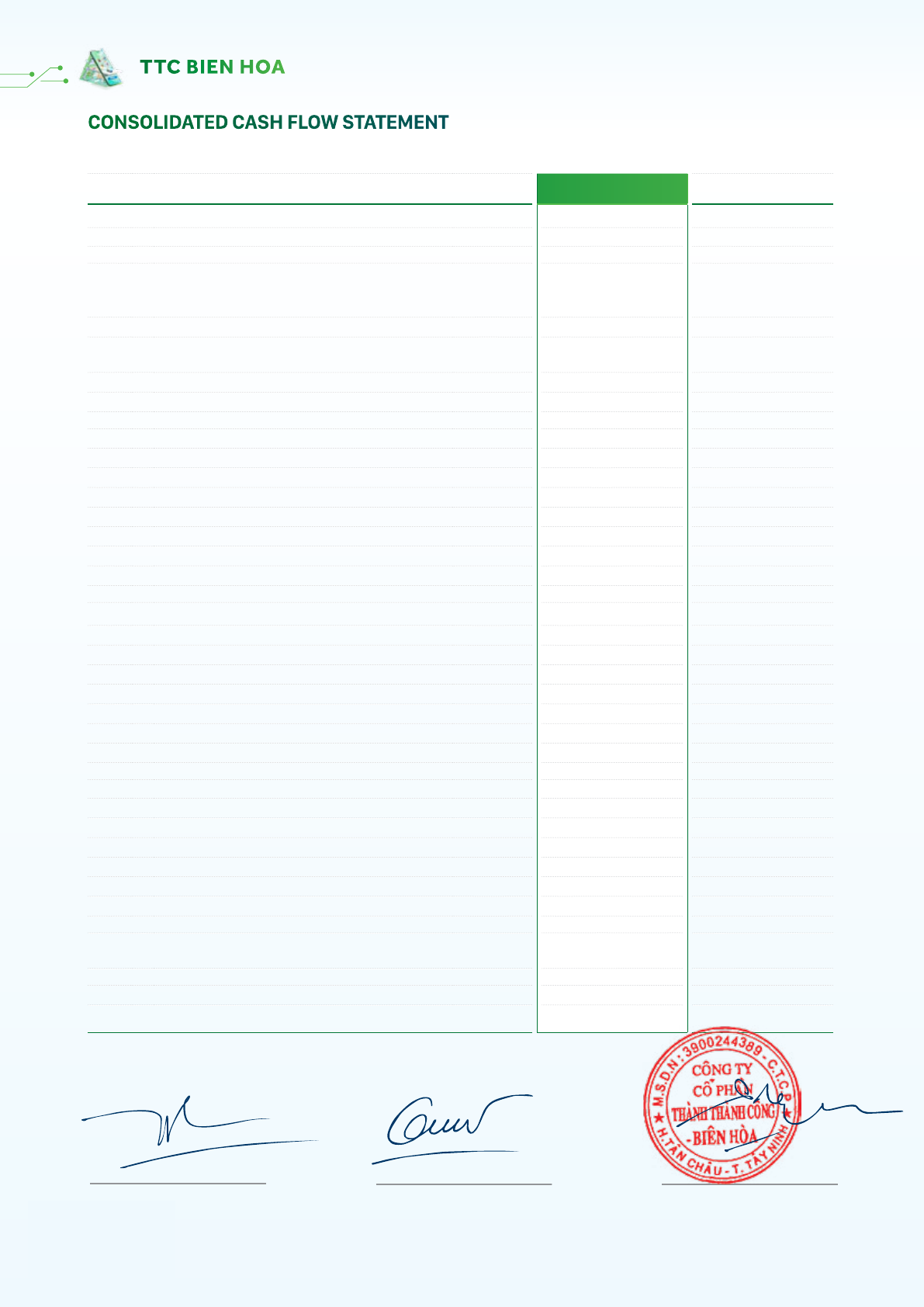

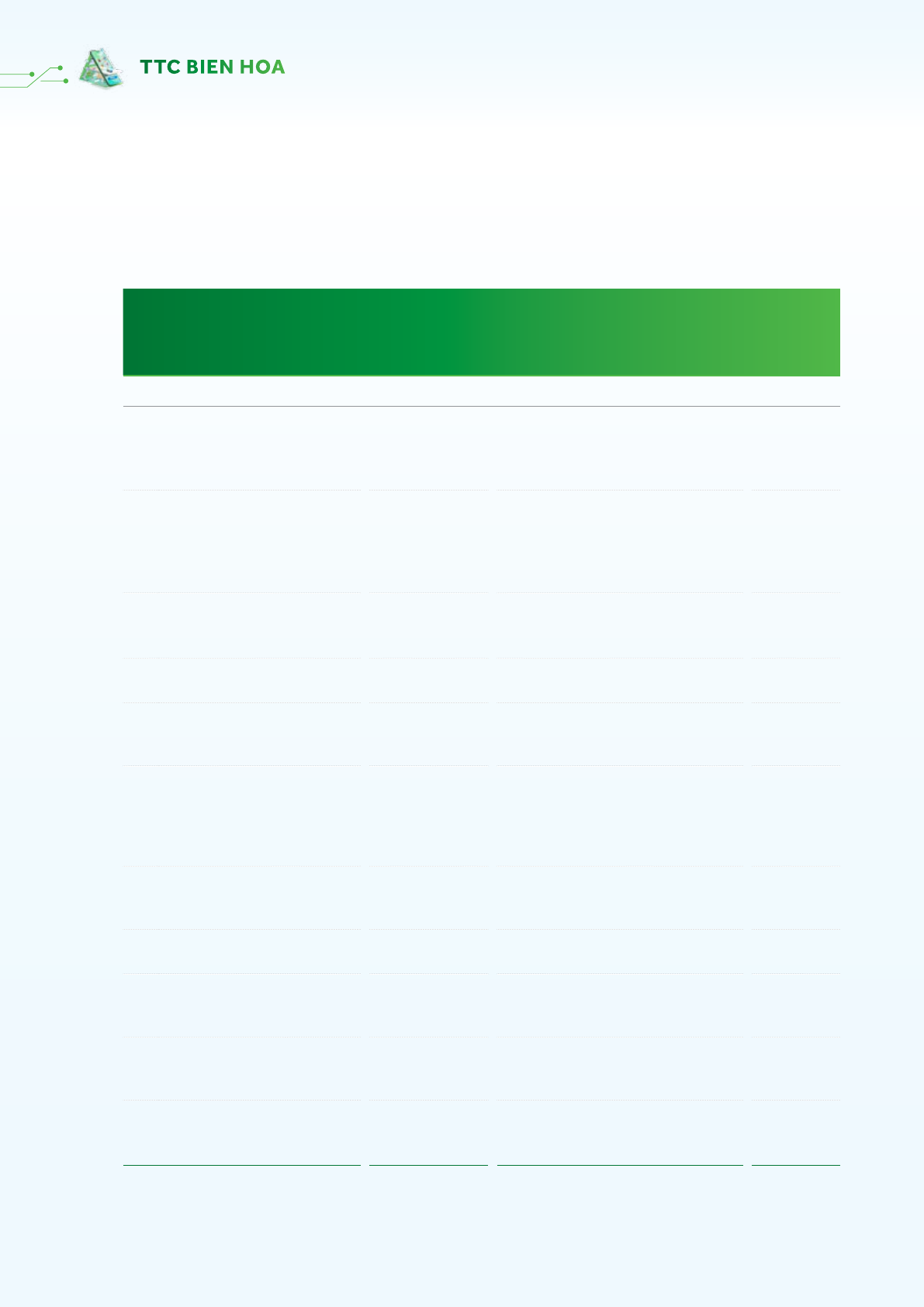

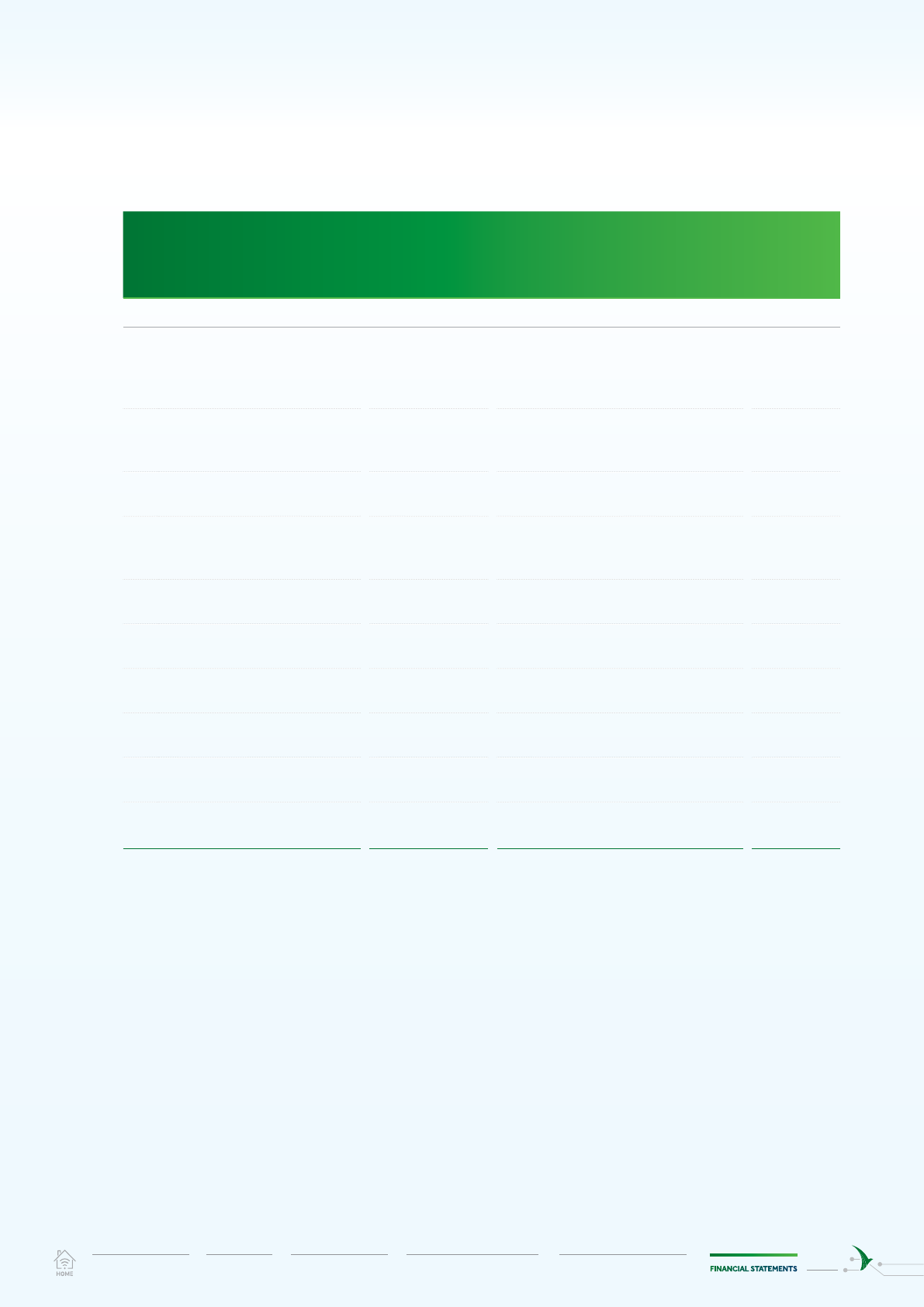

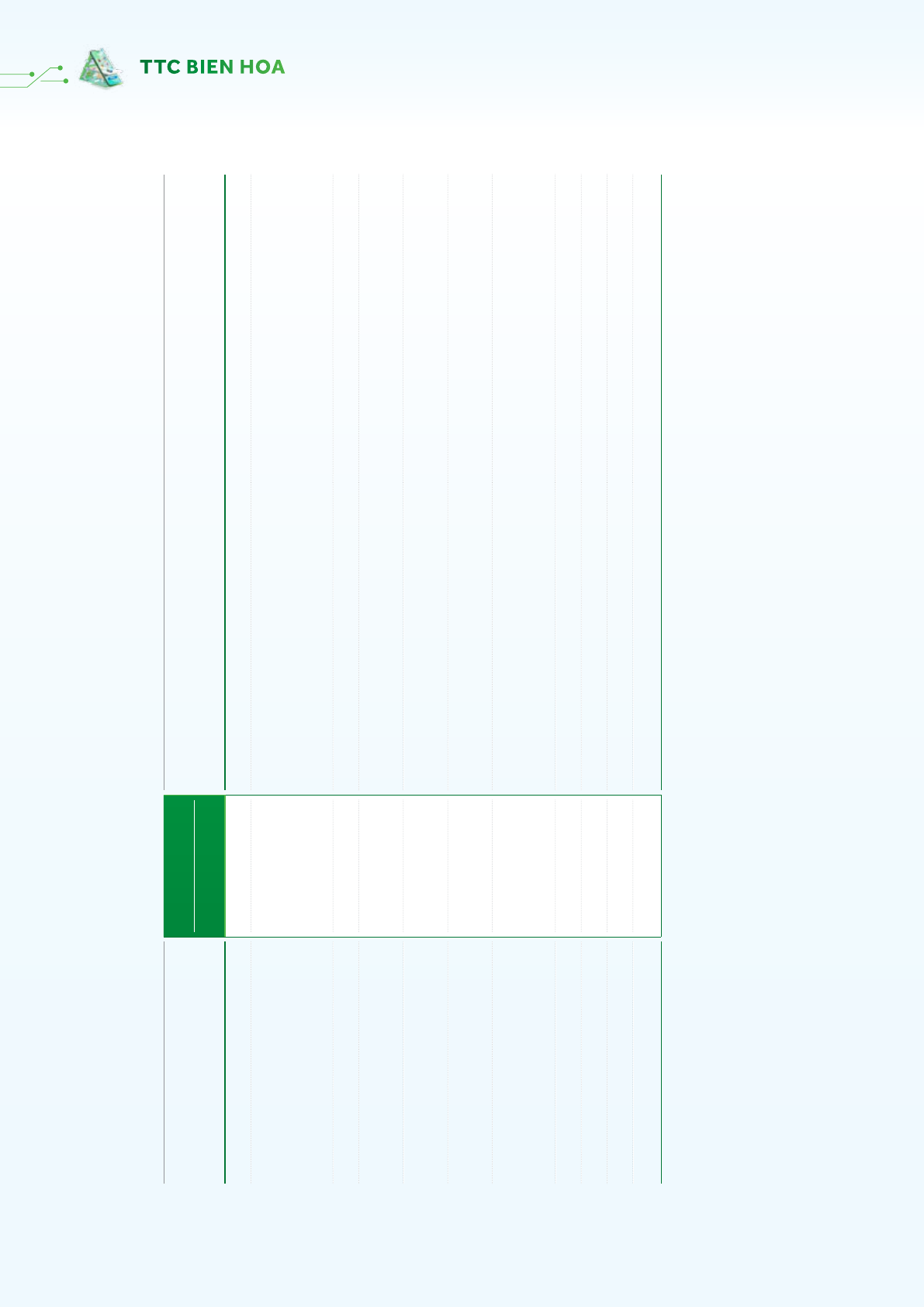

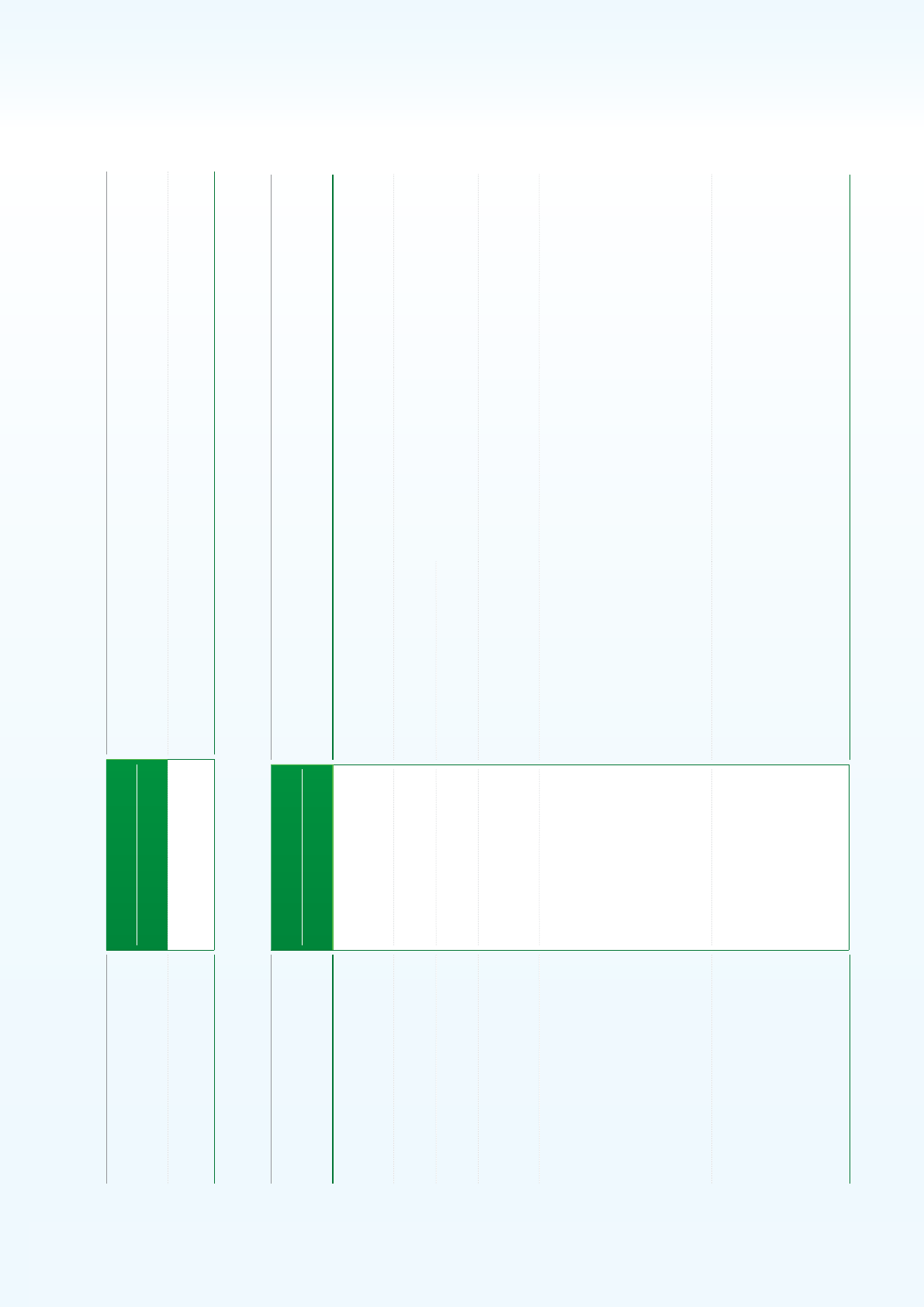

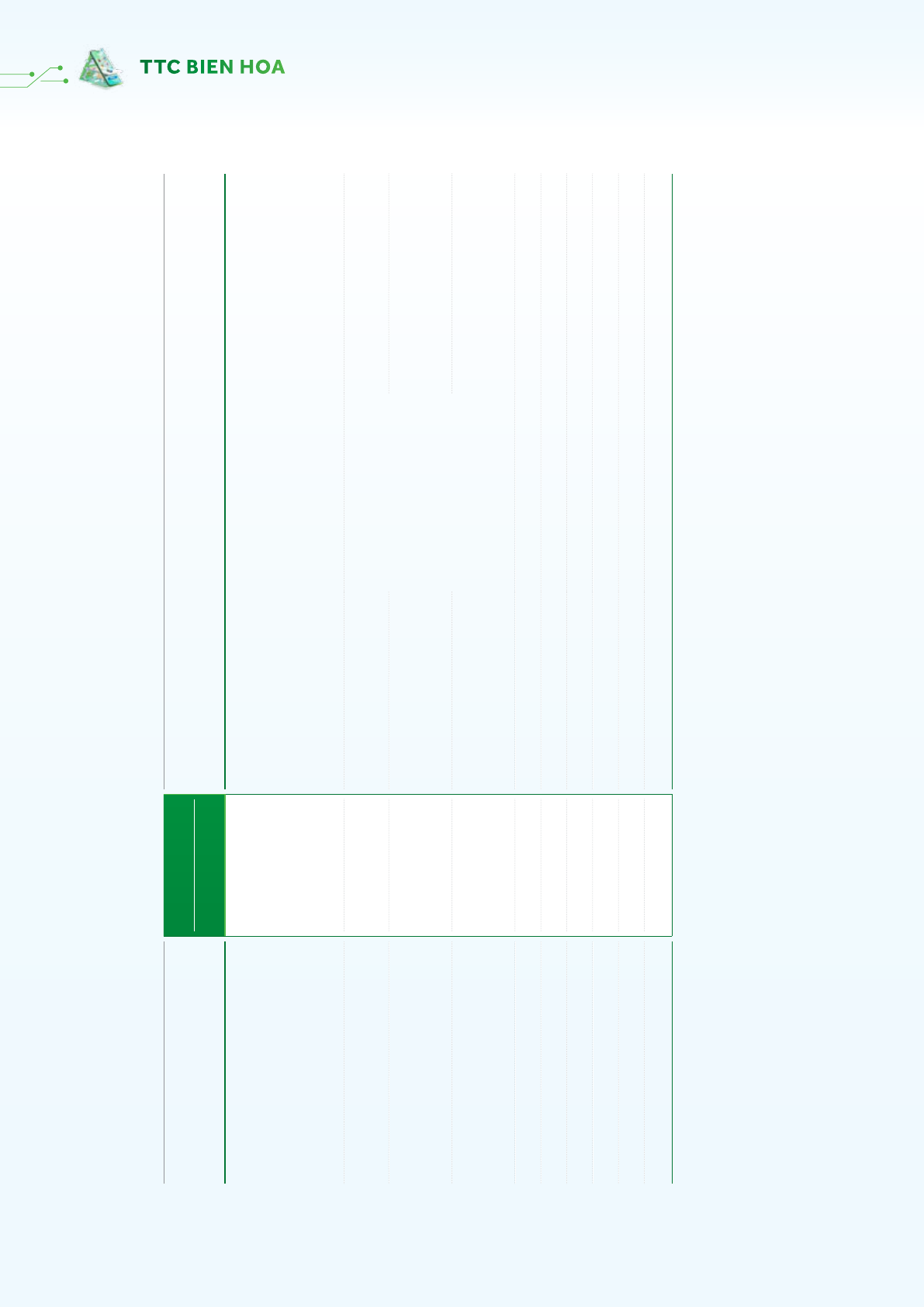

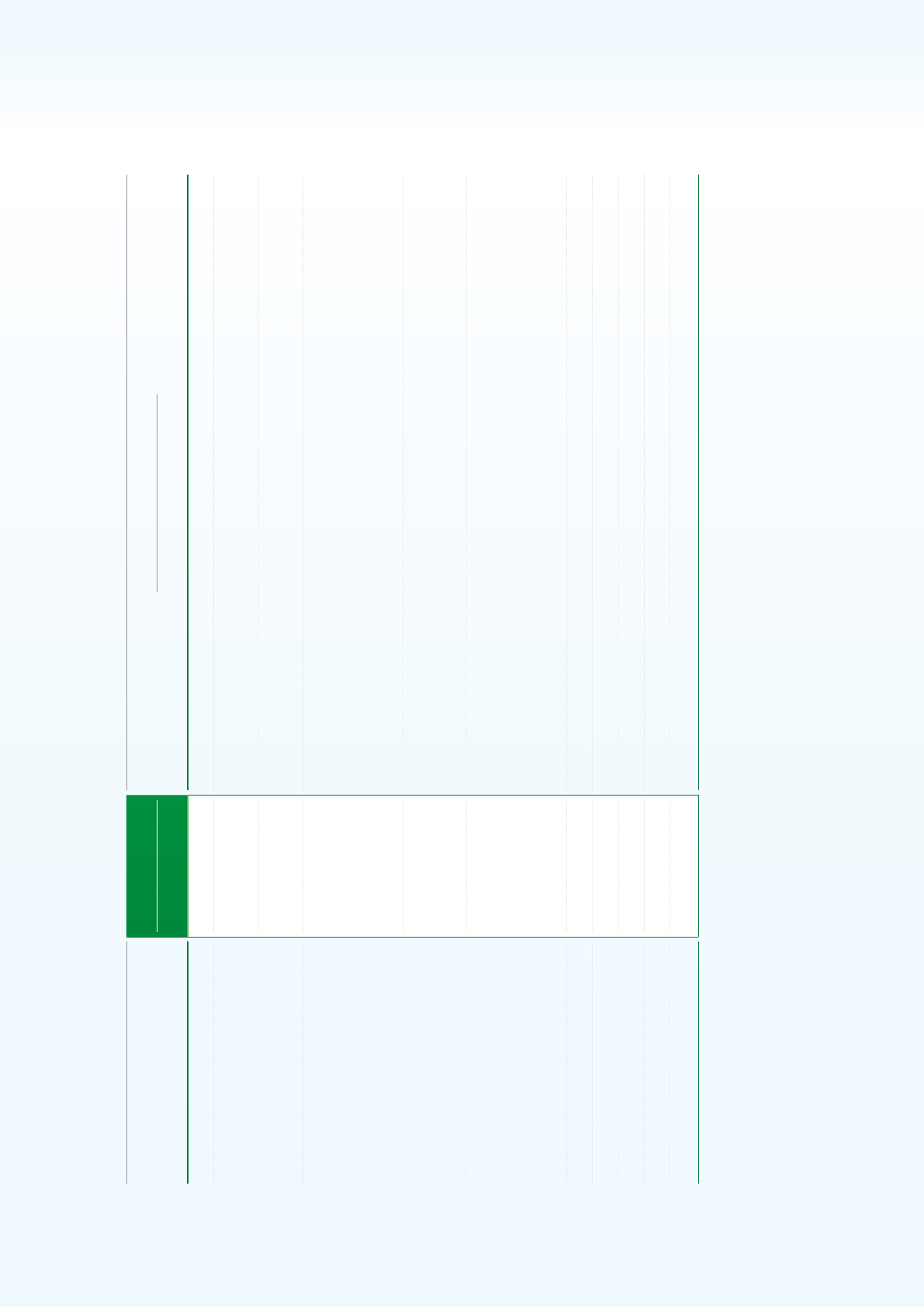

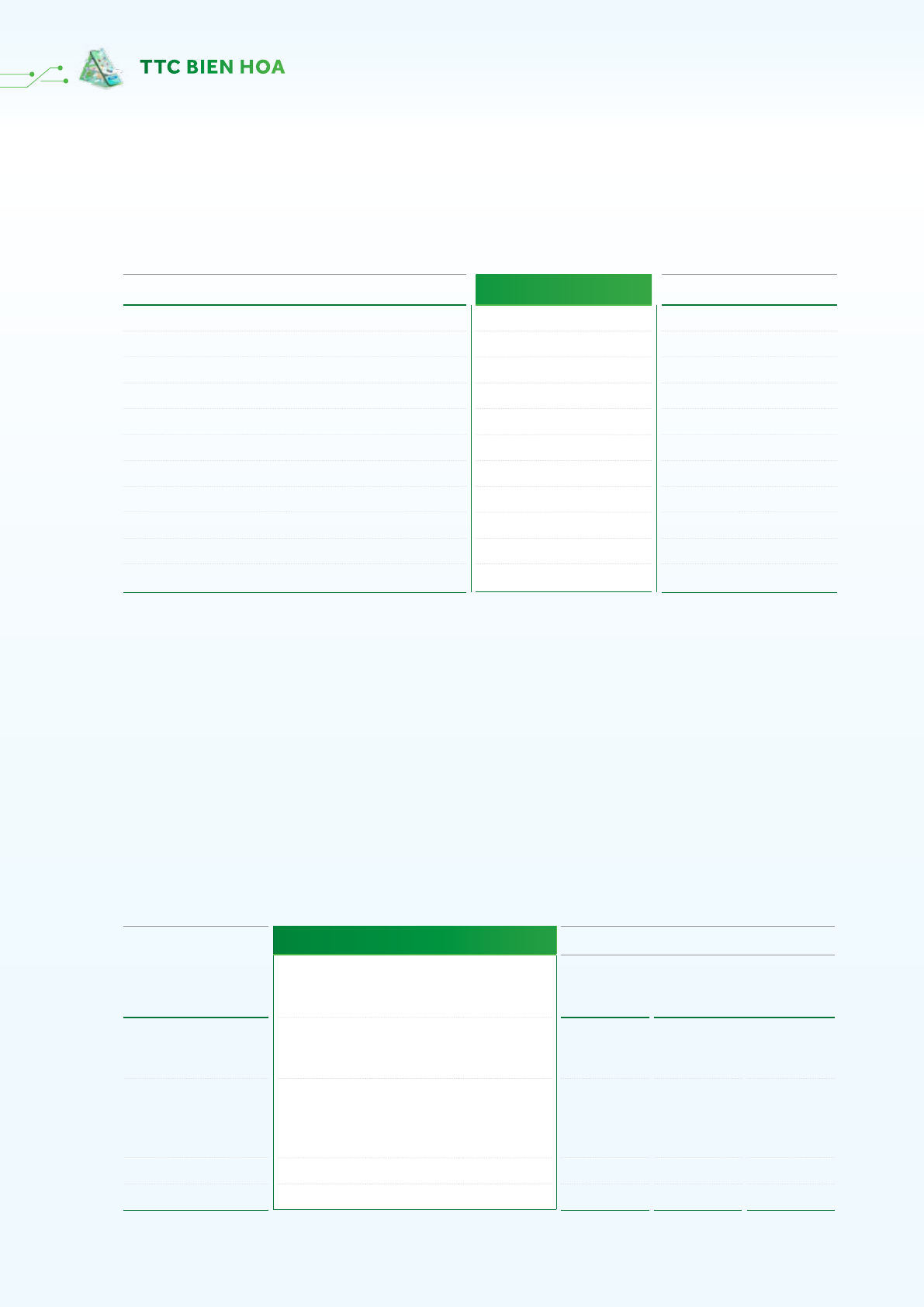

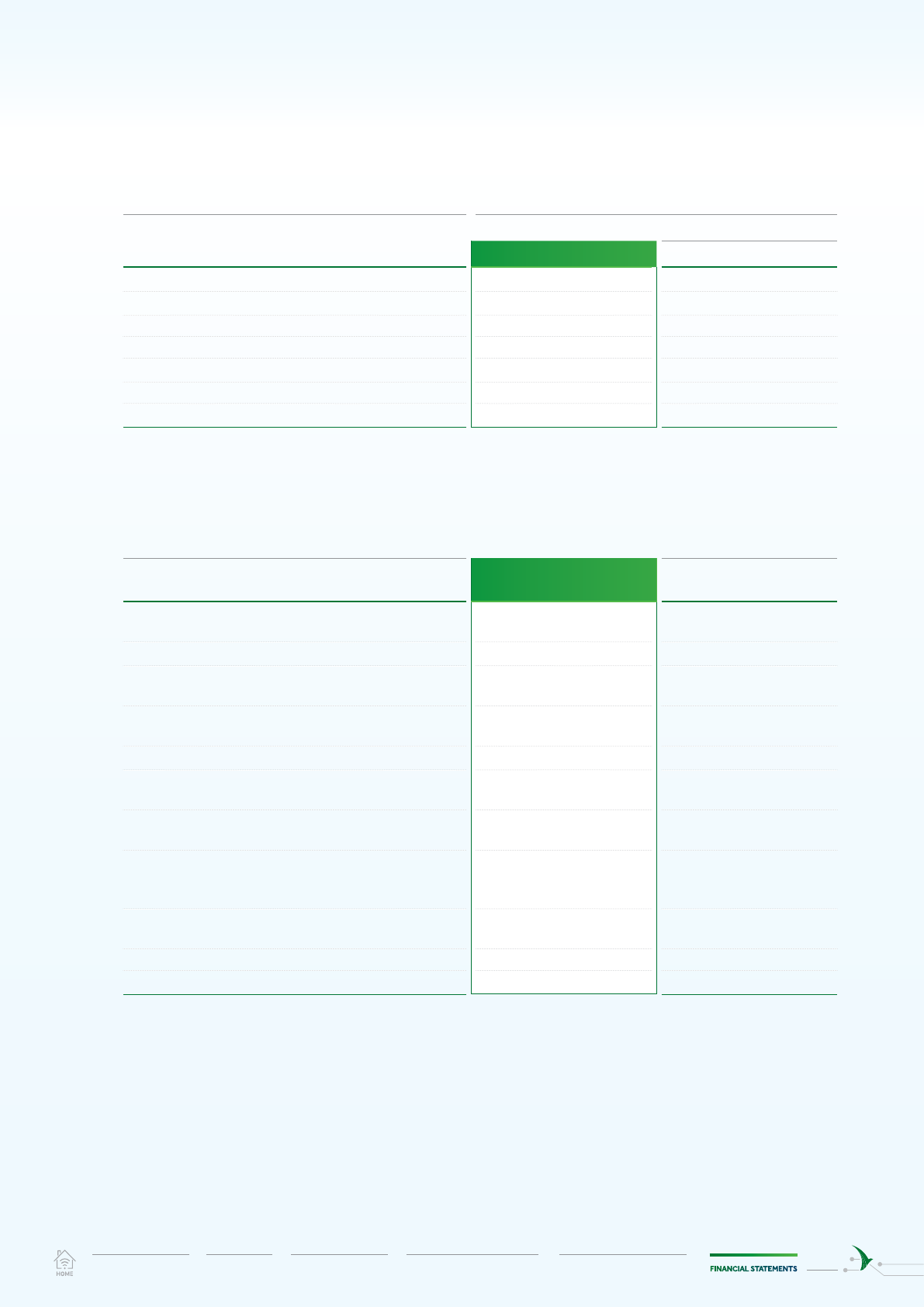

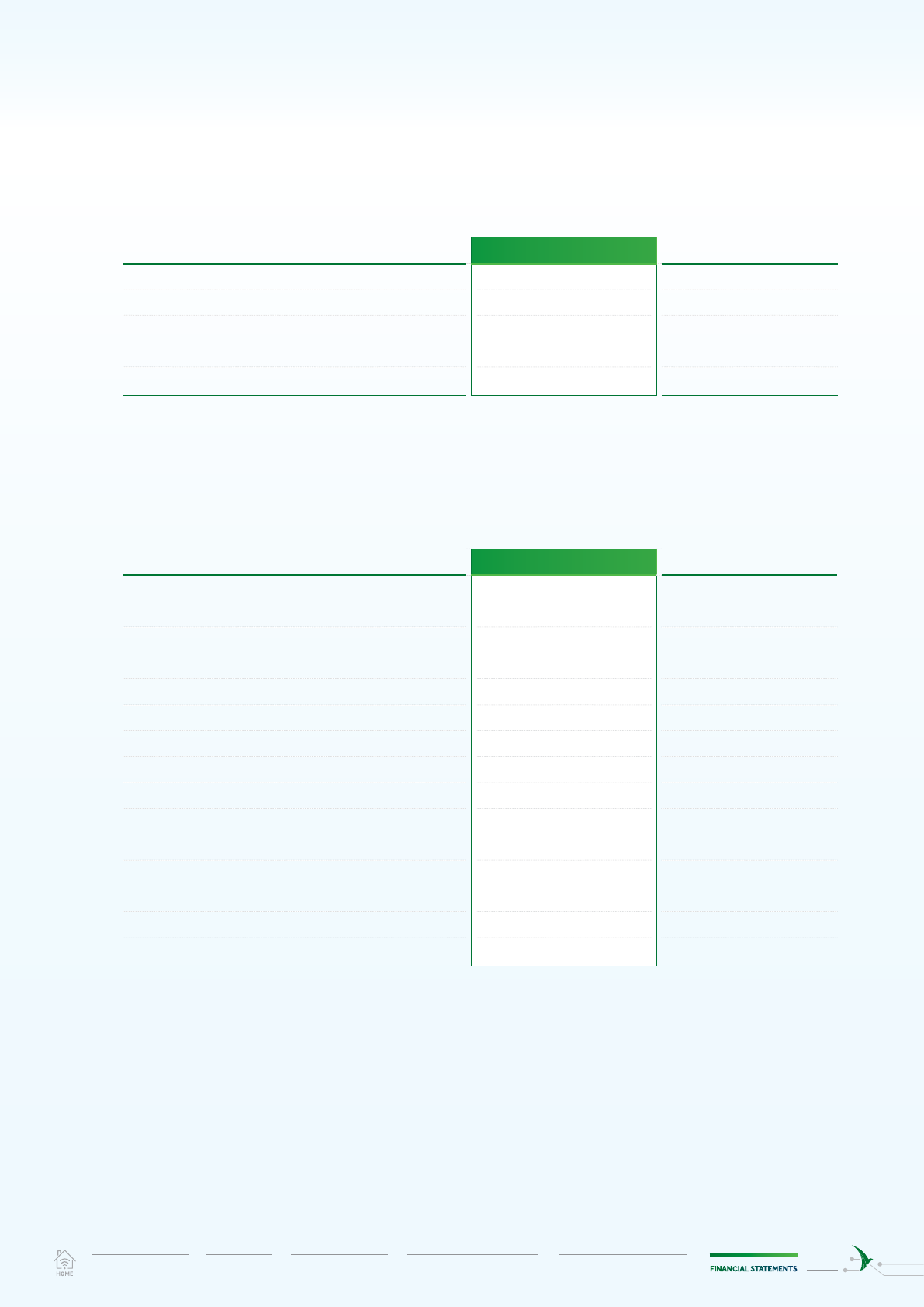

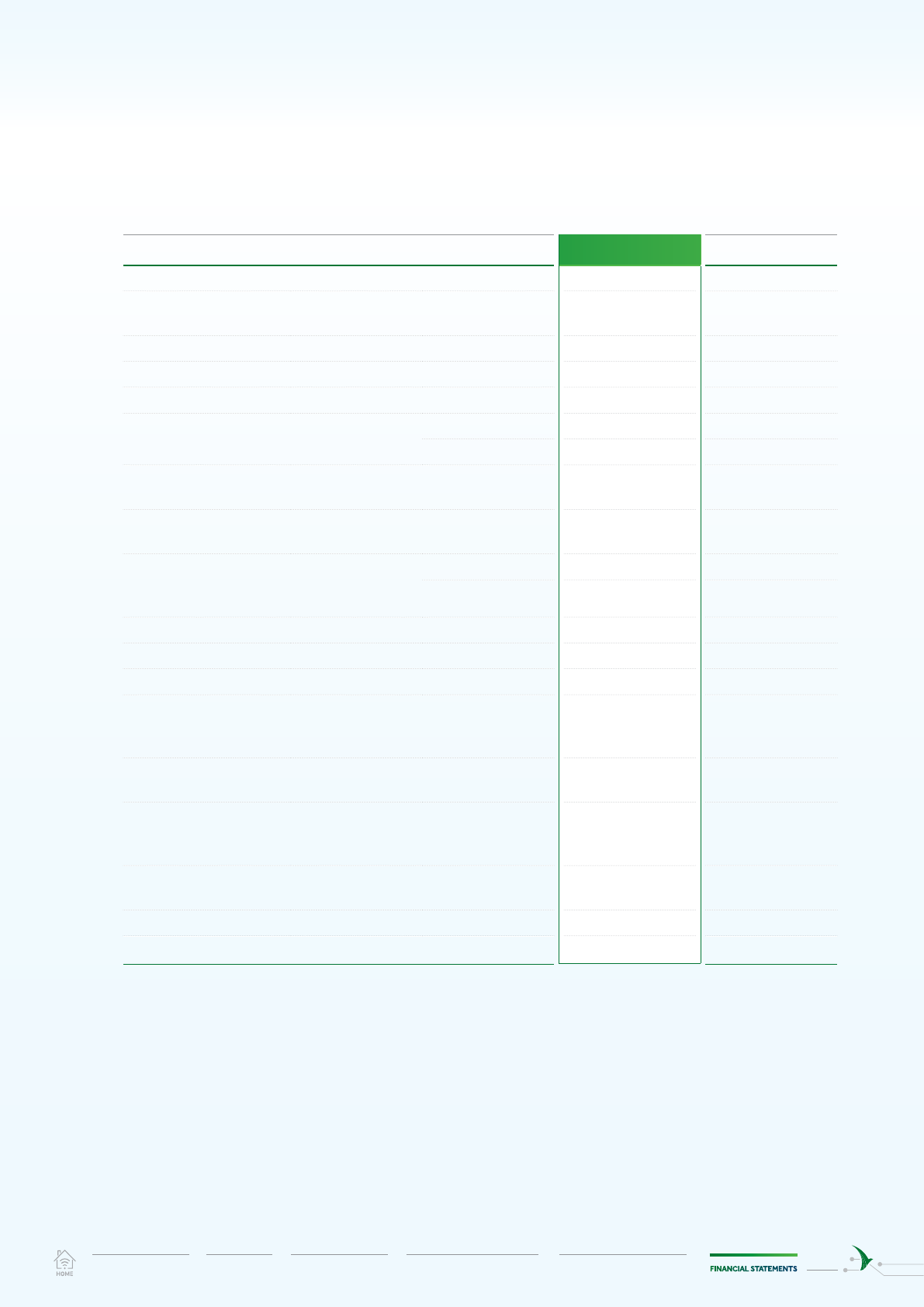

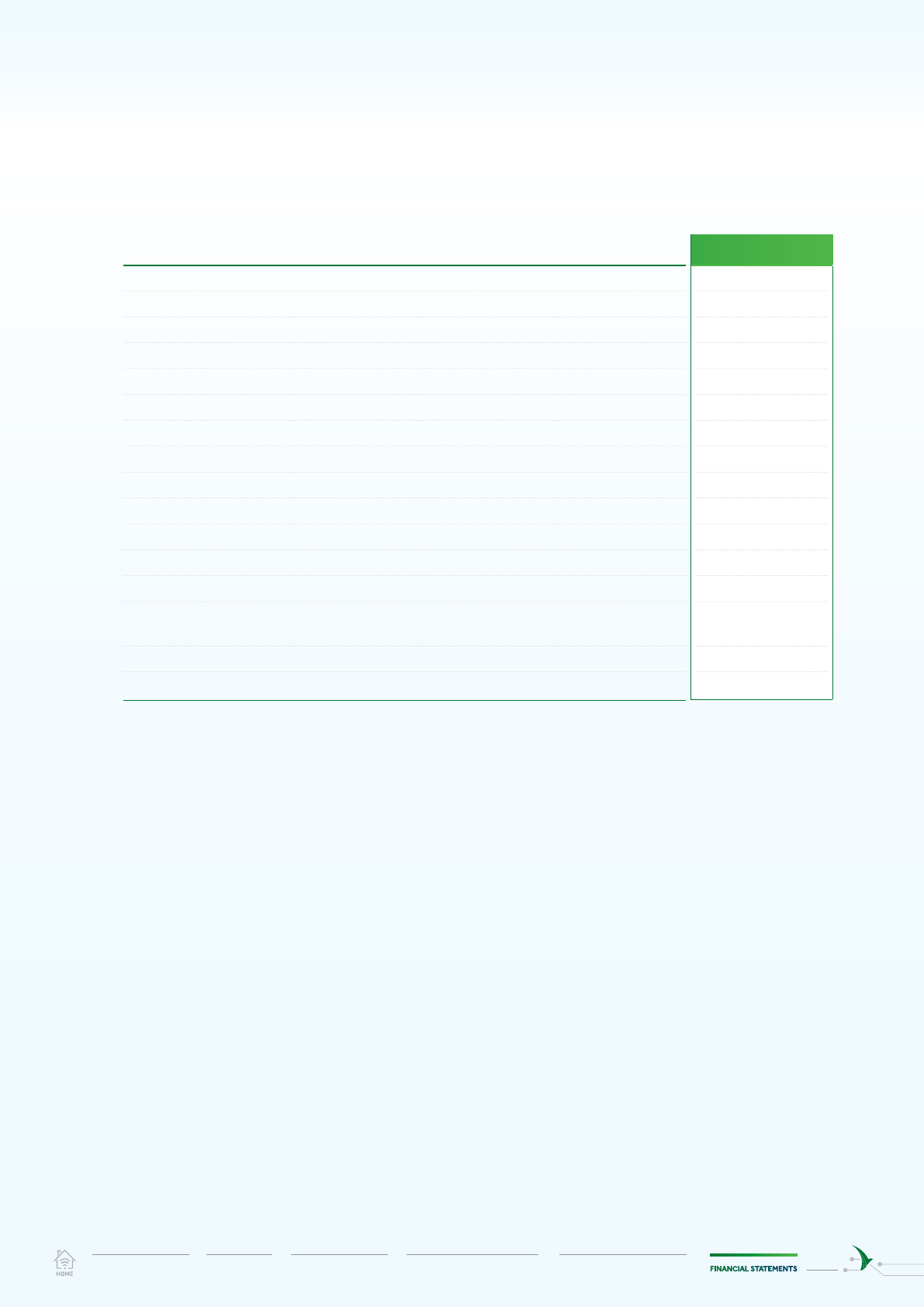

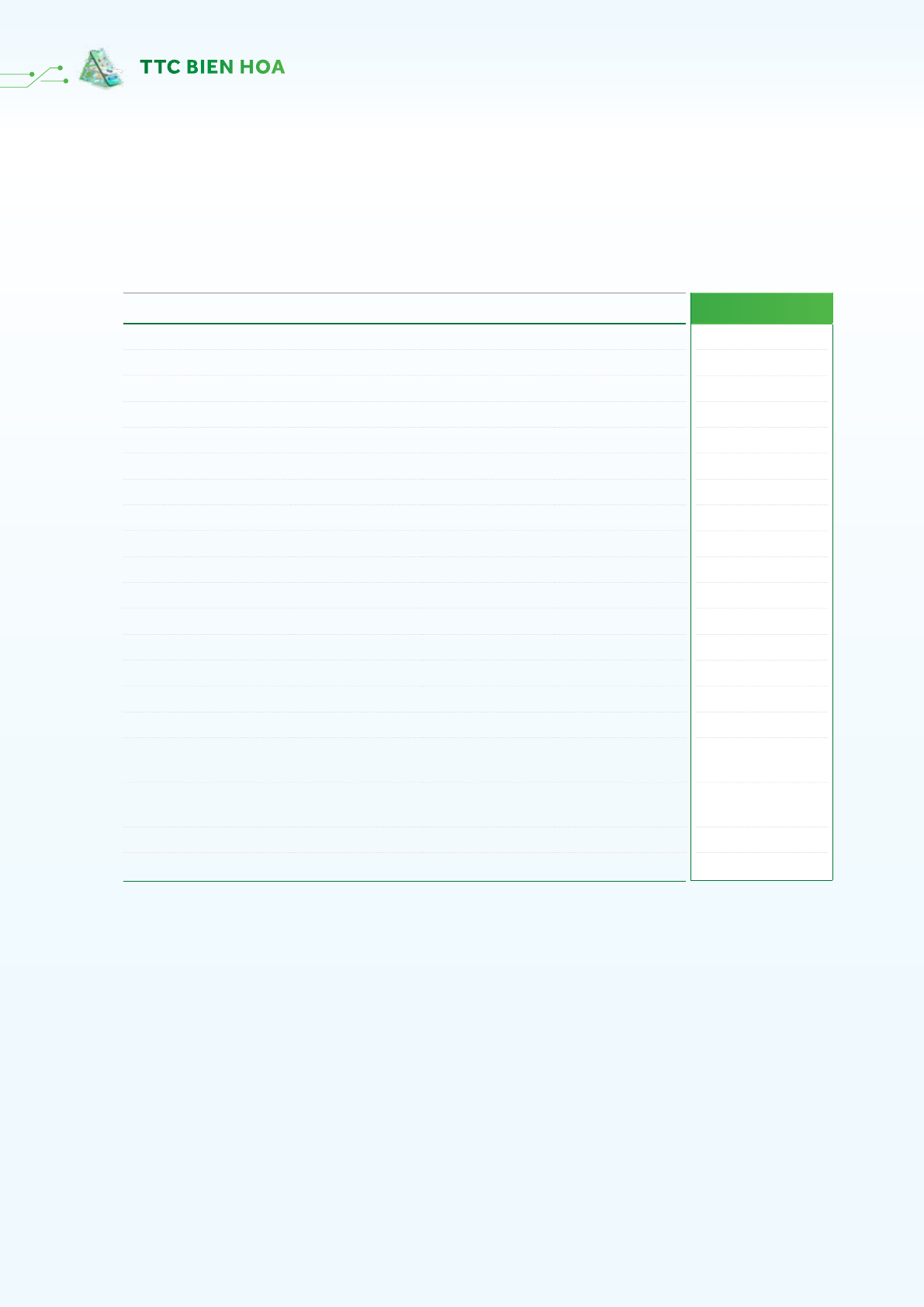

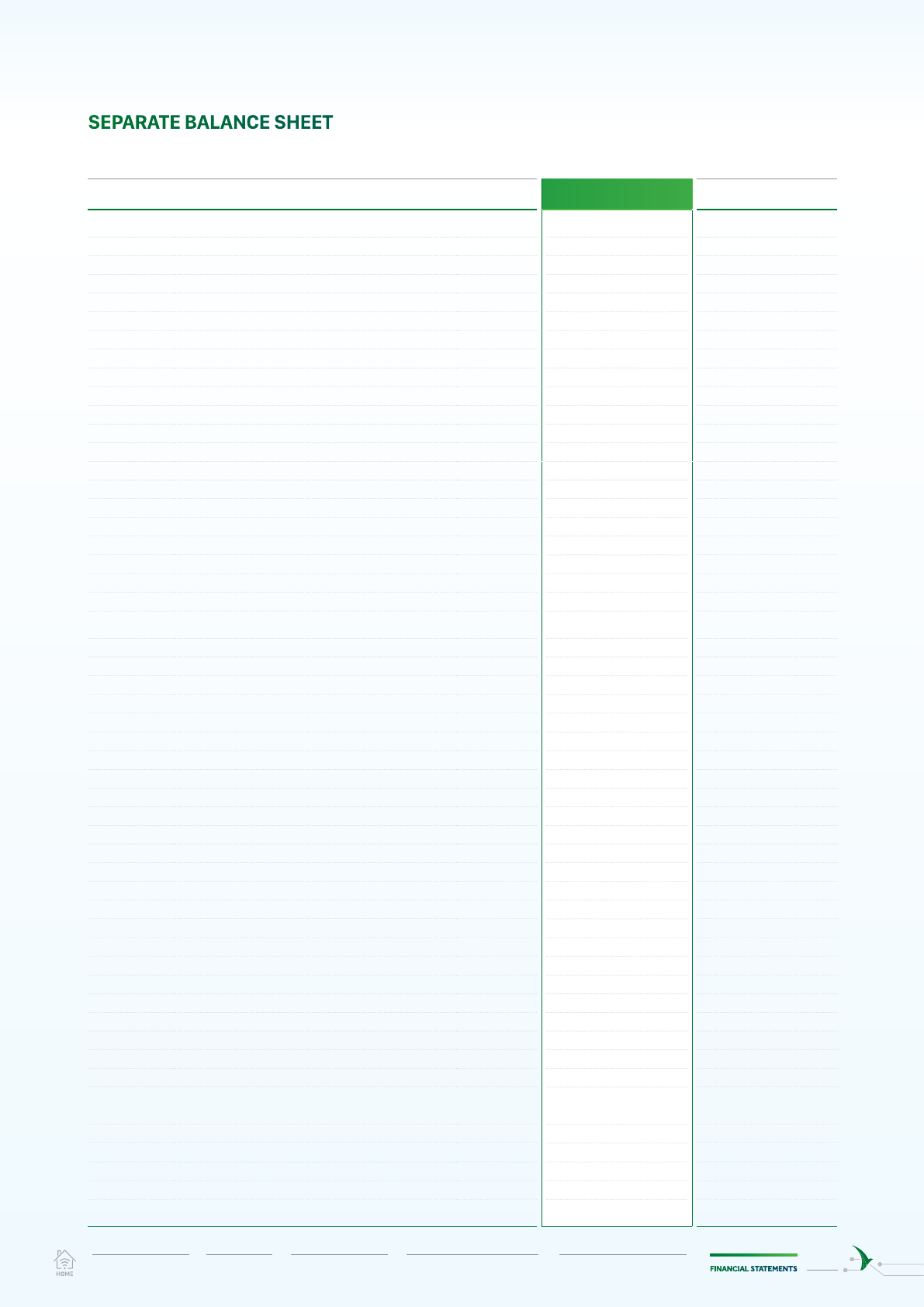

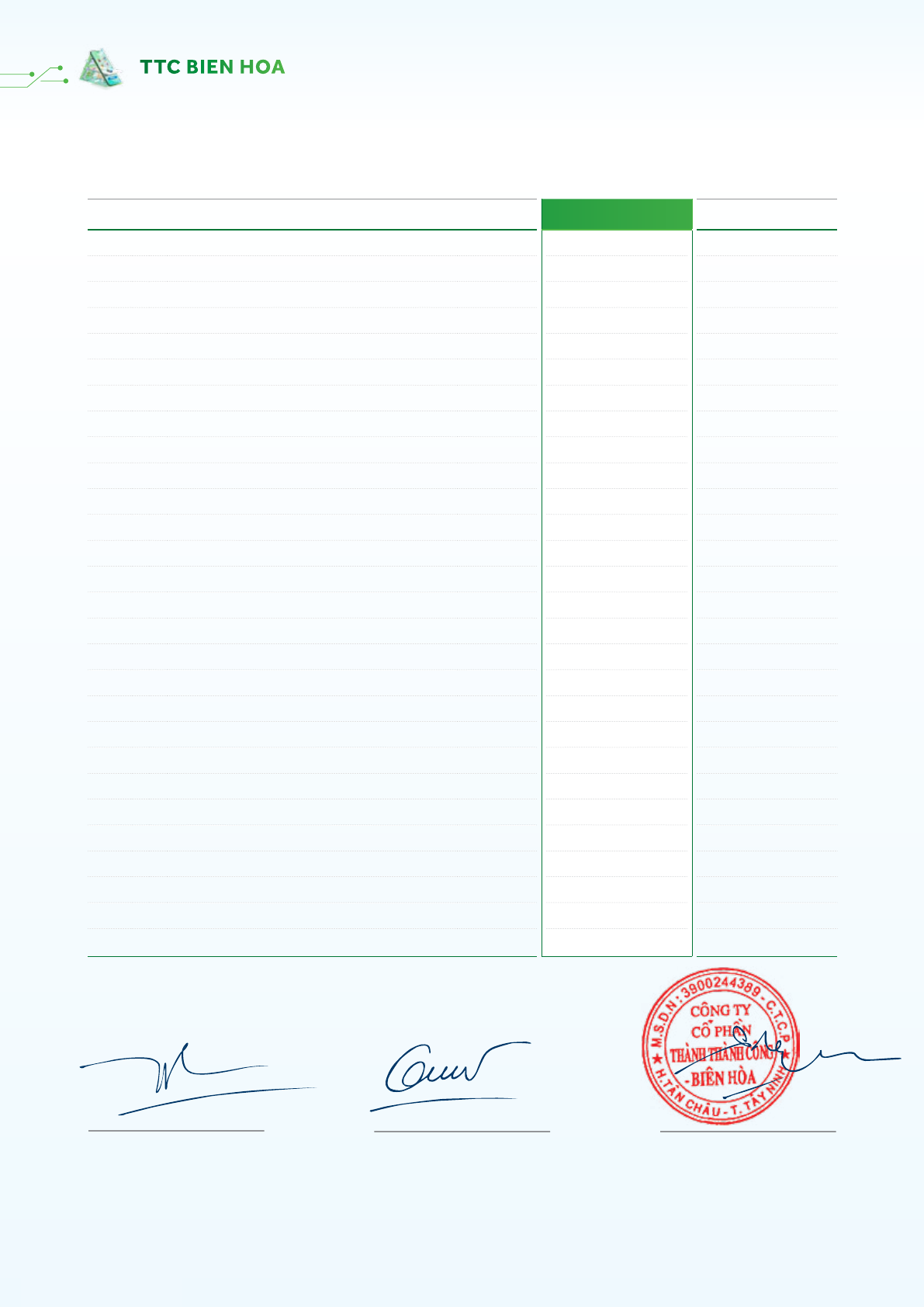

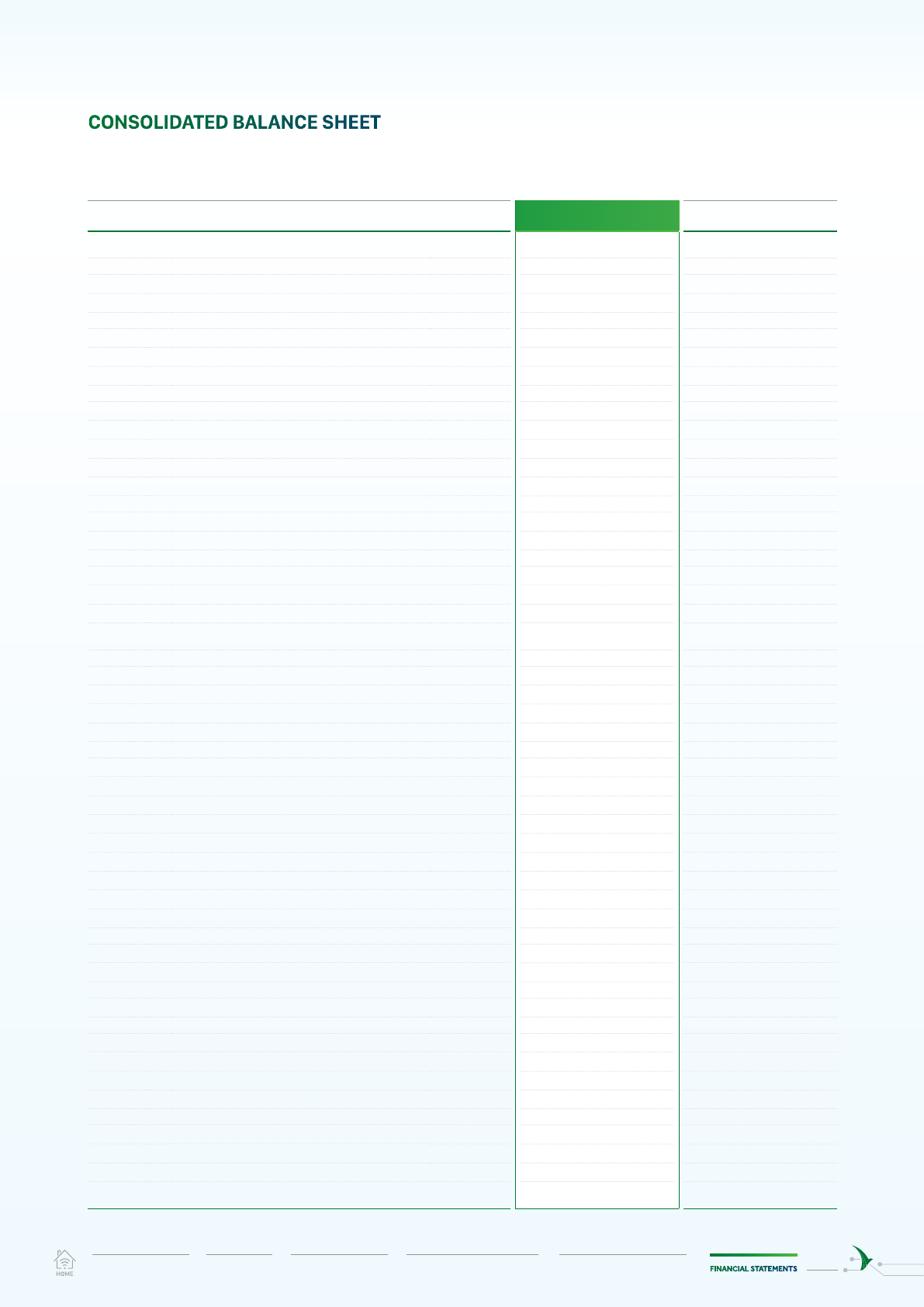

VND

Code ASSETS Notes Ending balance Beginning balance

100 A. CURRENT ASSETS 12,577,330,513,959 10,030,796,116,425

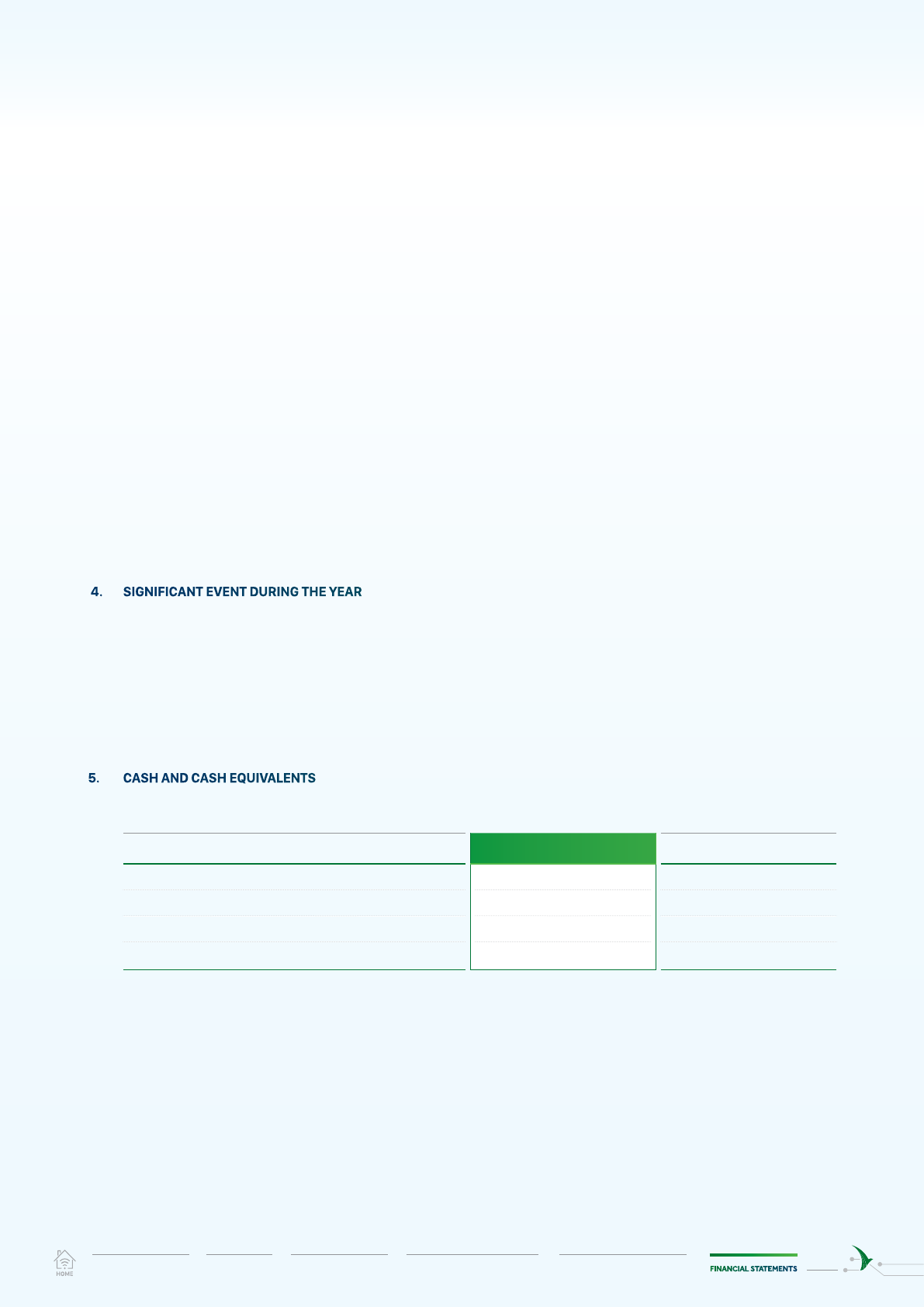

110 I. Cash and cash equivalents 5 1,823,297,113,682 999,620,661,512

111 1. Cash 1,008,162,514,798 799,320,661,512

112 2. Cash equivalents 815,134,598,884 200,300,000,000

120 II. Short-term investments 1,239,955,689,130 899,284,845,919

121 1. Held-for-trading securities 6 671,893,844,171 403,156,950,516

122 2. Provision for held-for-trading securities 6 (67,055,613,671) (43,067,104,597)

123 3. Held-to-maturity investments 7 635,117,458,630 539,195,000,000

130 III. Current accounts receivable 6,219,459,439,416 5,447,159,078,206

131 1. Short-term trade receivables 8 1,439,713,356,060 1,026,526,902,684

132 2. Short-term advances to suppliers 9 3,018,336,296,112 2,522,123,757,499

135 3. Short-term loan receivables 272,662,918 673,291,034

136 4. Other short-term receivables 10 1,811,707,695,287 1,937,434,918,704

137 5. Provision for doubtful short-term receivables 8, 9, 10 (50,570,570,961) (39,599,791,715)

140 IV. Inventories 11 3,158,779,109,857 2,529,346,657,059

141 1. Inventories 3,176,587,967,128 2,541,154,800,749

149 2. Provision for obsolete inventories (17,808,857,271) (11,808,143,690)

150 V. Other current assets 135,839,161,874 155,384,873,729

151 1. Short-term prepaid expenses 12 25,488,691,285 48,619,538,175

152 2. Value-added tax deductible 22 97,009,072,862 92,081,678,271

153 3. Tax and other receivables from the State 22 13,341,397,727 14,683,657,283

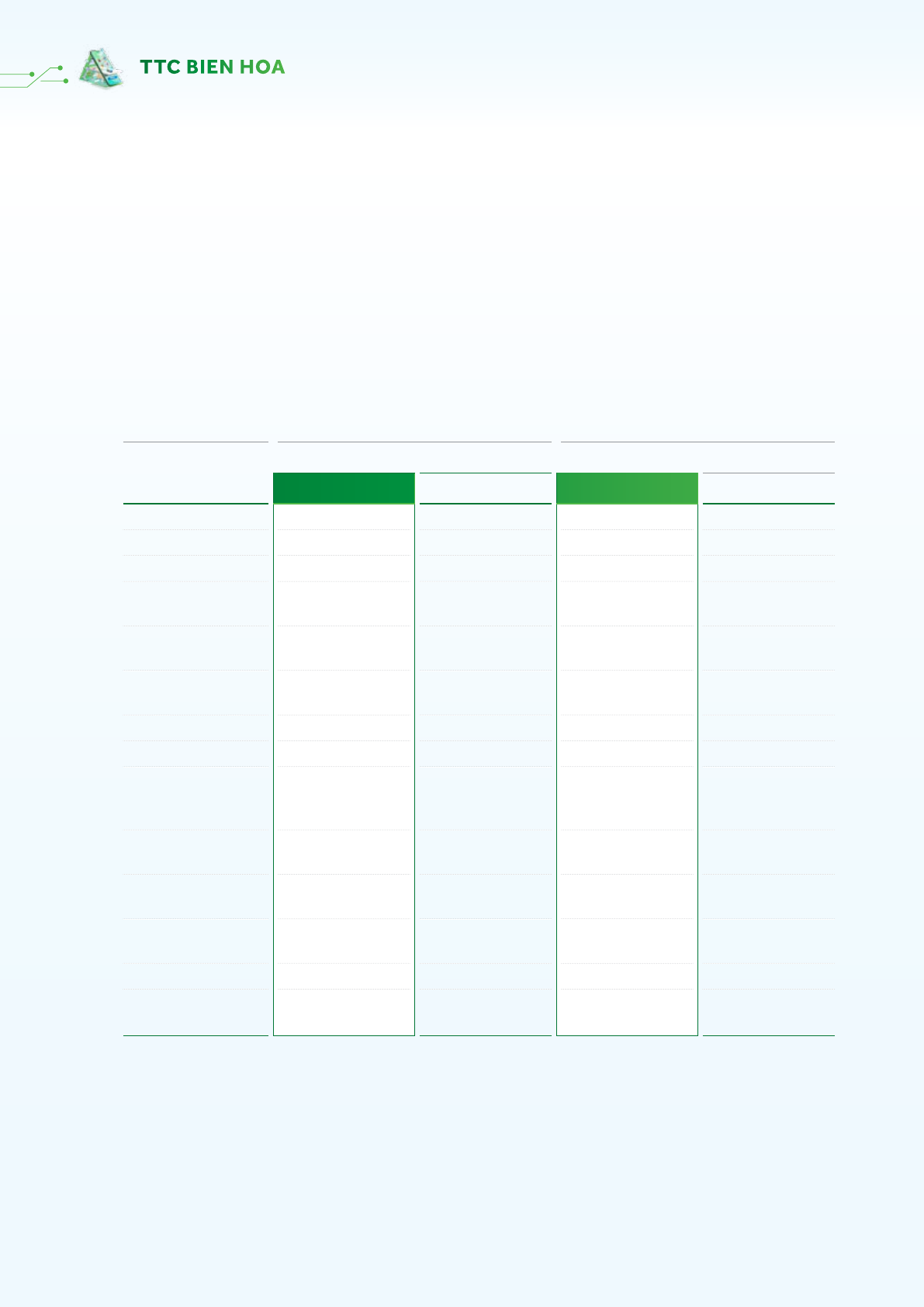

200 B. NON-CURRENT ASSETS 7,893,568,735,300 7,924,922,667,487

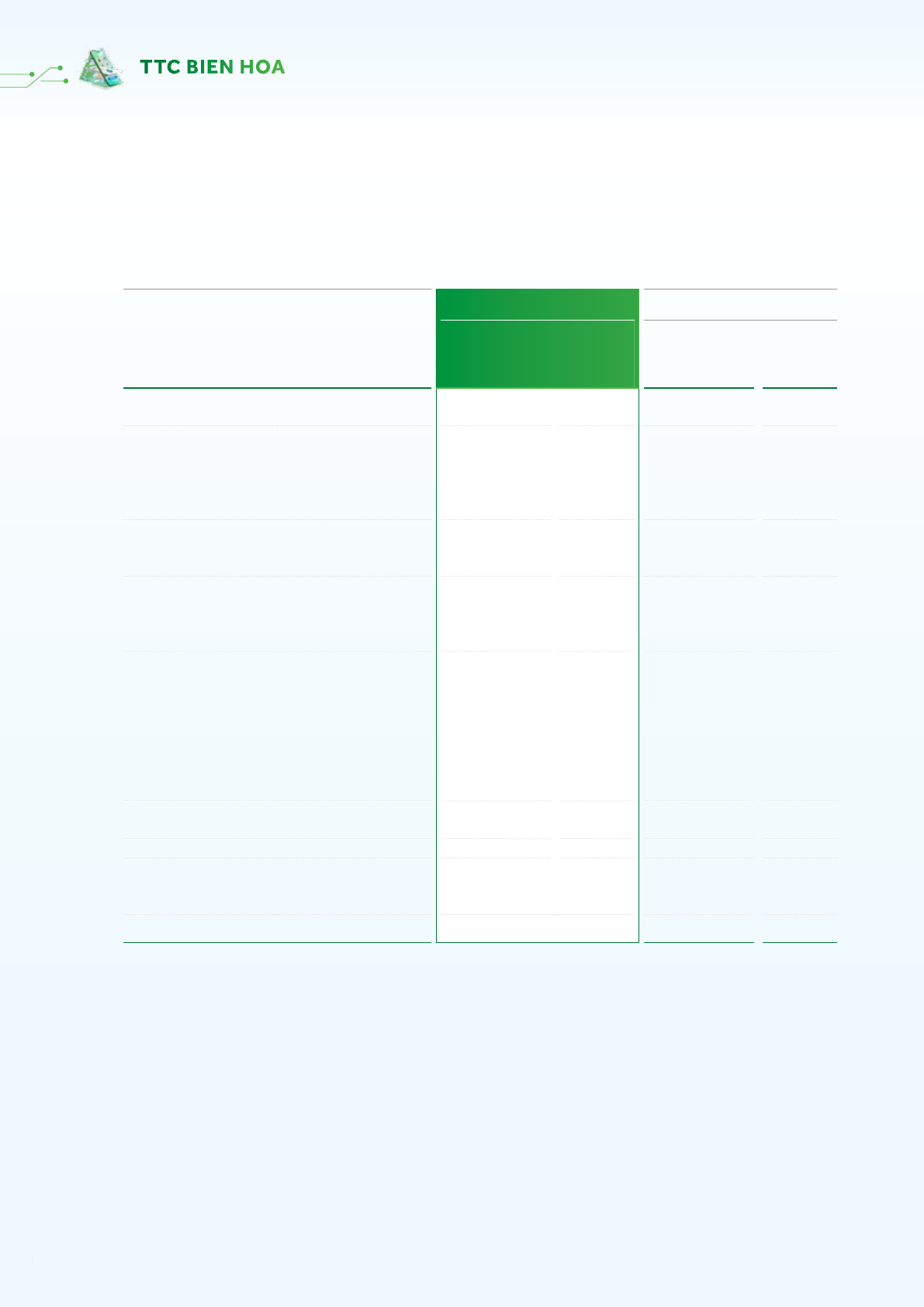

210 I. Long-term receivables 134,910,654,507 101,806,889,451

212 1. Long-term advances to suppliers 9 97,009,546,692 92,623,661,450

215 2. Long-term loan receivables 3,085,633,364 -

216 3. Other long-term receivables 10 77,766,758,024 9,183,228,001

219 4. Provision for doubtful long-term receivables 9 (42,951,283,573) -

220 II. Fixed assets 3,922,472,696,557 4,179,804,562,879

221 1. Tangible xed assets 13 3,495,944,778,665 3,844,903,217,562

222 Cost 8,315,932,564,826 8,484,840,315,880

223 Accumulated depreciation (4,819,987,786,161) (4,639,937,098,318)

224 2. Finance leases 14 96,193,621,914 108,160,541,664

225 Cost 114,851,907,684 140,481,291,500

226 Accumulated depreciation (18,658,285,770) (32,320,749,836)

227 3. Intangible xed assets 15 330,334,295,978 226,740,803,653

228 Cost 407,760,556,202 284,497,398,107

229 Accumulated amortisation (77,426,260,224) (57,756,594,454)

230 III. Investment properties 16 577,878,136,995 592,437,897,729

231 1. Cost 633,621,394,024 638,075,095,511

232 2. Accumulated depreciation (55,743,257,029) (45,637,197,782)

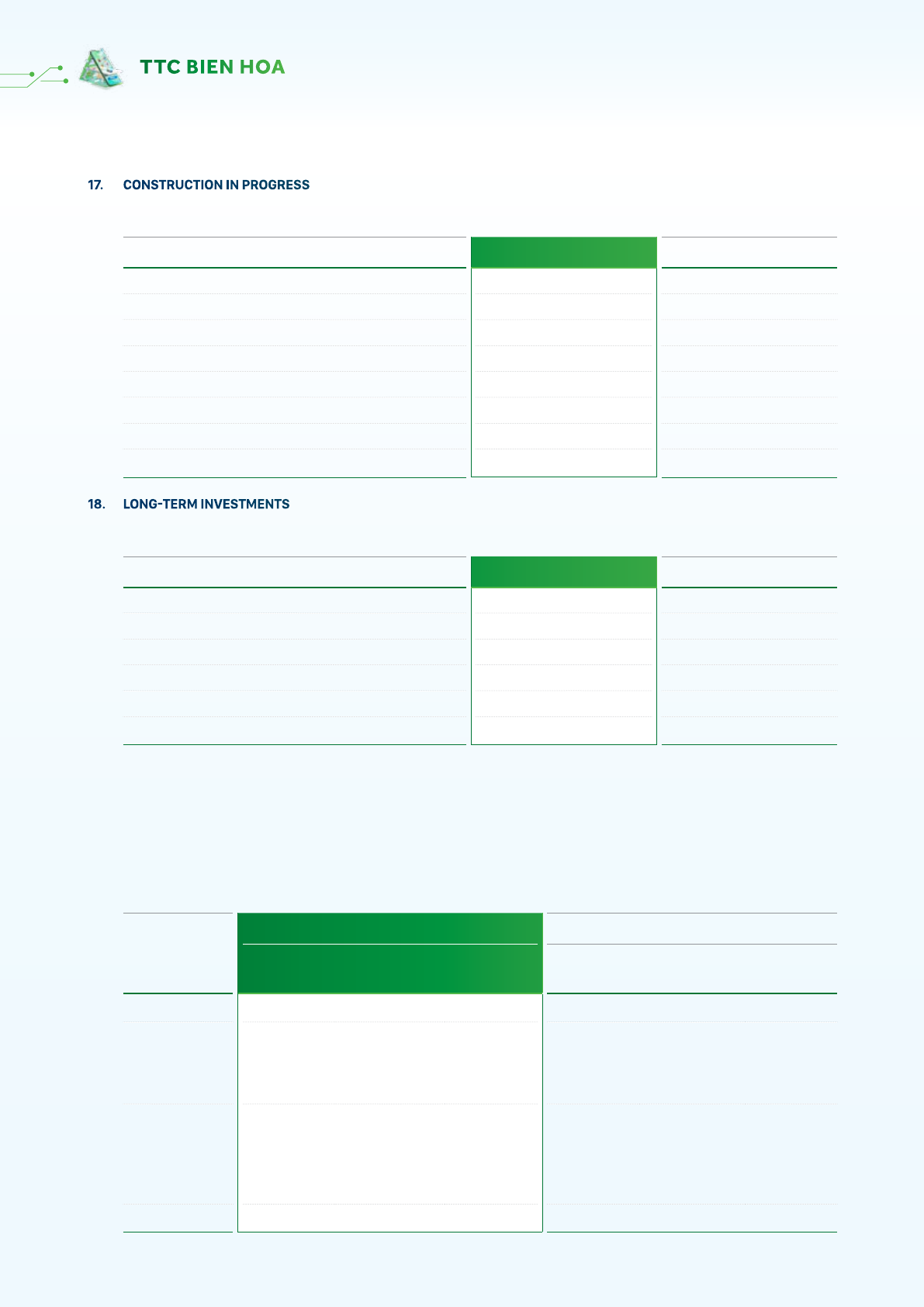

240 IV. Long-term asset in progress 404,248,687,906 341,526,808,768

242 1. 1. Construction in progress 17 404,248,687,906 341,526,808,768

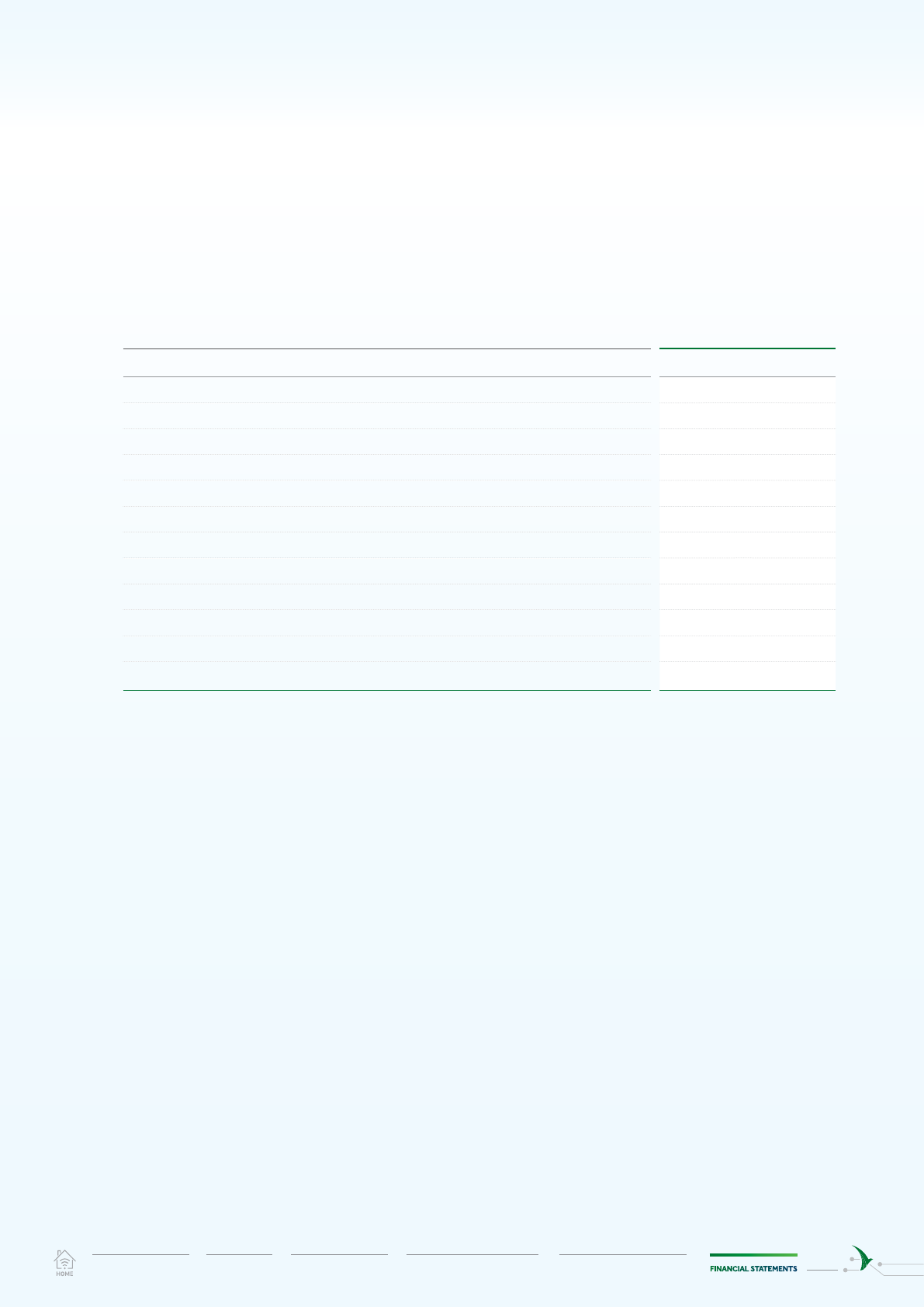

250 V. Long-term investments 18 1,411,279,203,604 1,245,605,087,900

252 1. Investments in associates 18.1 366,562,215,361 381,424,975,548

253 2. Investments in other entities 18.2 941,013,453,920 767,001,478,655

254 3. Provision for long-term investments (6,976,465,677) (2,001,366,303)

255 4. Held-to-maturity investments 18 110,680,000,000 99,180,000,000

260 VI. Other long-term assets 1,442,779,355,731 1,463,741,420,760

261 1. Long-term prepaid expenses 12 1,303,267,123,794 1,319,693,751,650

262 2. Deferred tax assets 35.3 26,067,595,226 10,072,275,631

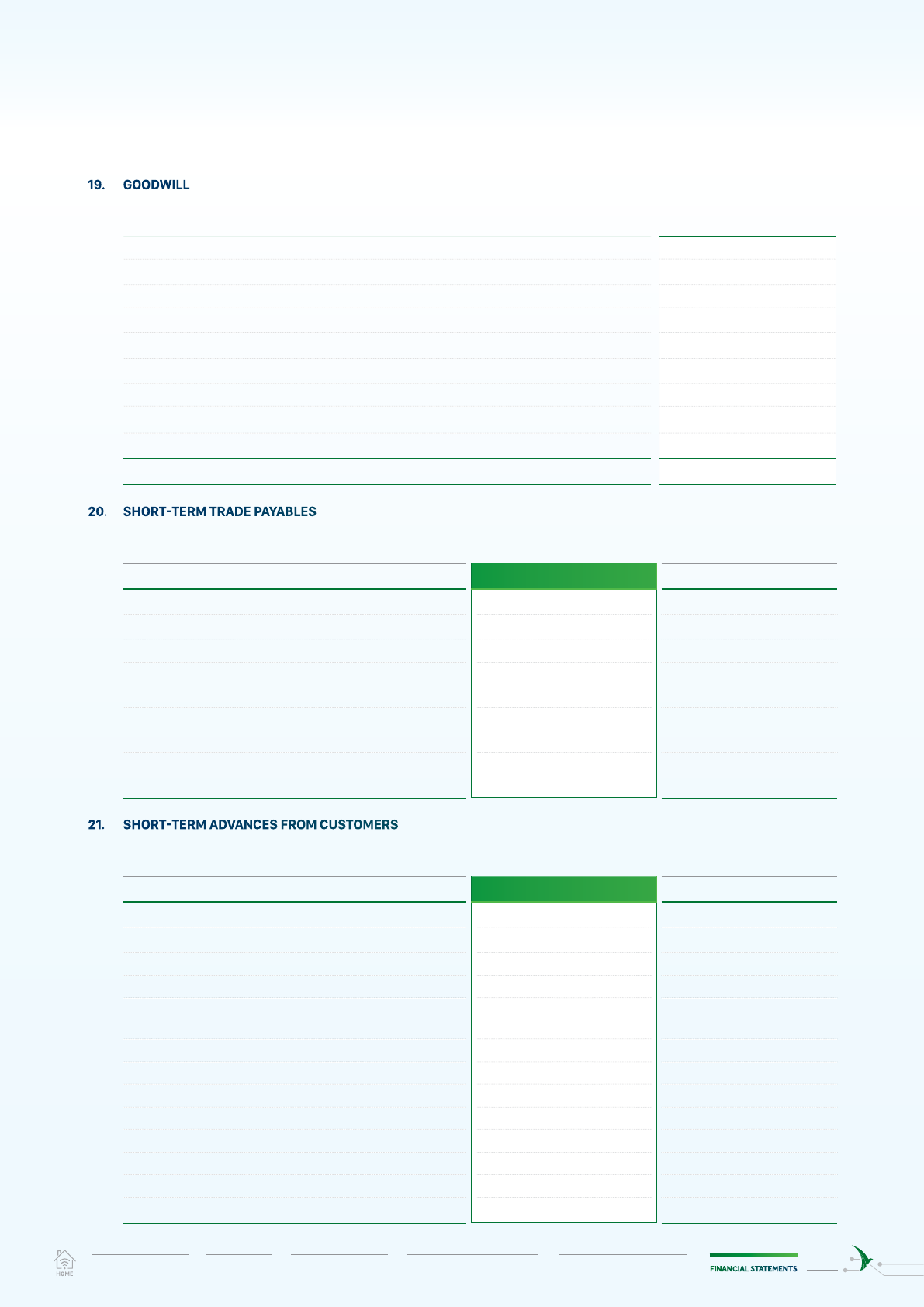

269 3. Goodwill 19 113,444,636,711 133,975,393,479

270 TOTAL ASSETS 20,470,899,249,259 17,955,718,783,912

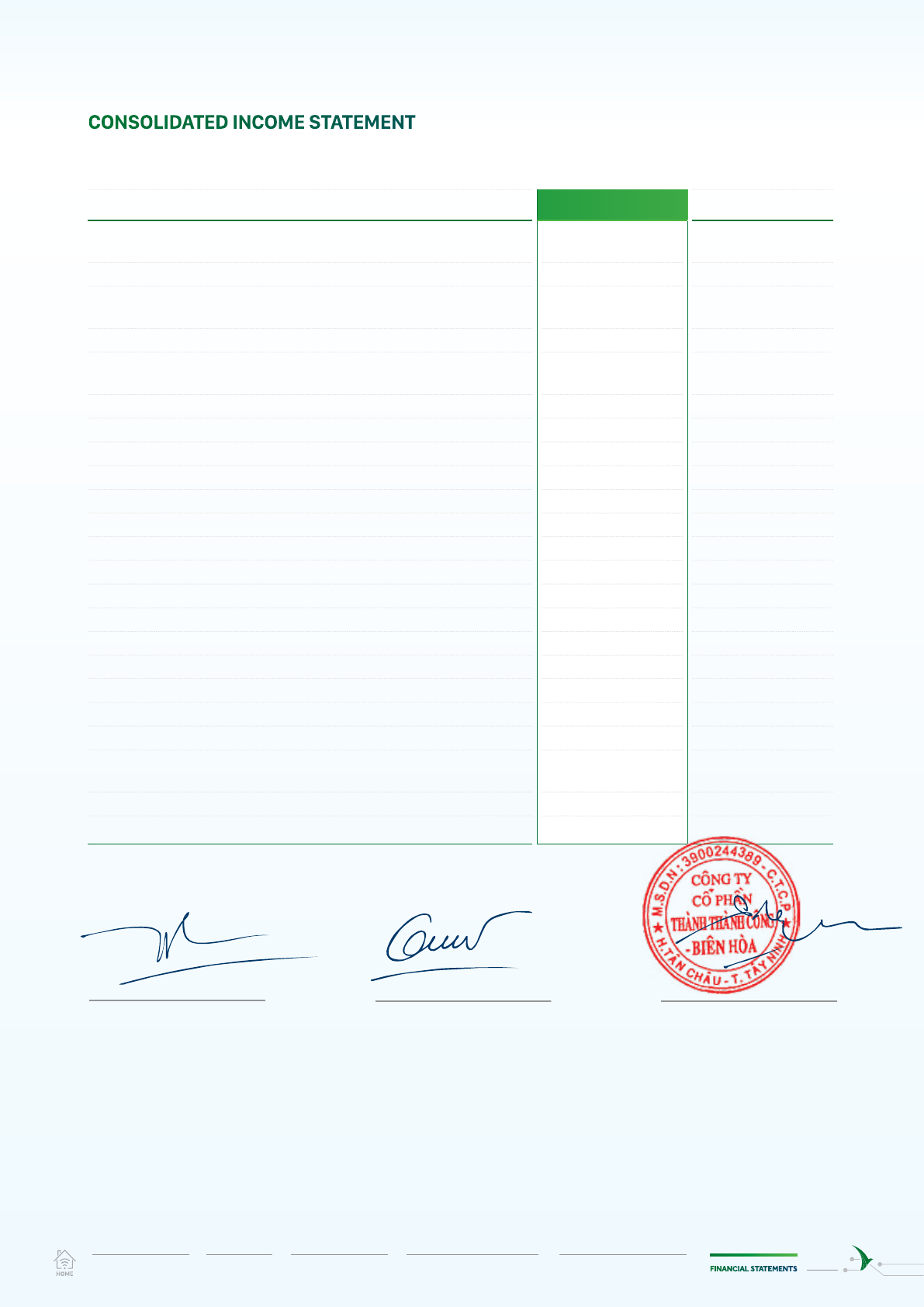

CONSOLIDATED BALANCE SHEET

as at 30 June 2021

B01-DN/HN

SBT AT GLANCE CORPORATE GOVERNANCE OPERATION THROUGHOUT THE YEAR SUSTAINABLE DEVELOPMENT REPORT FINANCIAL STATEMENTSSBT - IMPRINT OF THE YEAR

267